Can you find a good property in Valencia below €250,000?

For many expat investors, €250,000 feels like a realistic entry point for buying property in Valencia. It is an amount that still opens up good neighbourhoods and renovated homes, without needing to move into the luxury bracket. However, it is important to remember that you cannot allocate the full €250,000 to the purchase price.

When buying property in Valencia, you need to plan for 10 to 15 percent in additional costs on top of the price of the flat. These include:

Transfer tax (ITP): 10% of the purchase price

Land registry fee: around €500

Notary fees: usually between €500 and €1,000

Agency commission: typically 3% of the purchase price + 21% VAT, unless you buy directly from a private seller

In practice, a €250,000 budget often means looking at properties in the €210,000 to €230,000 range, unless you are adding savings or financing to cover the total.

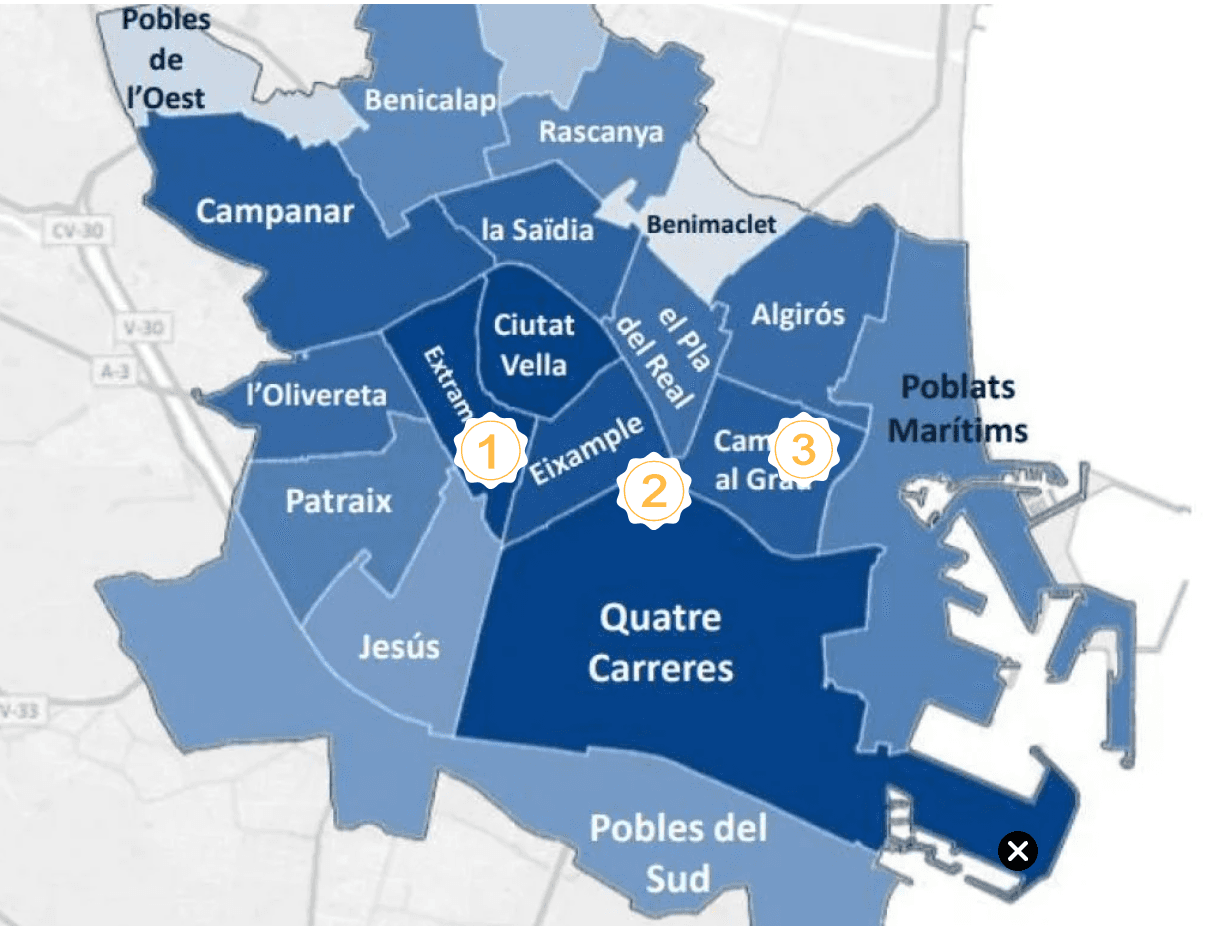

To illustrate what this looks like on the ground, we will use three live examples from Idealista in late 2025: one in Patraix–Arrancapins, one in Mont-Olivet (Quatre Carreres) and one in El Grau (Poblats Marítims).

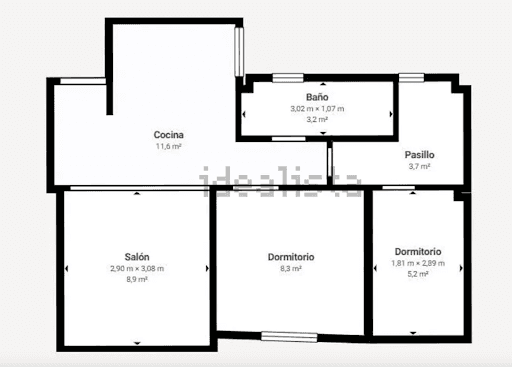

Case study 1 – renovated 2-bedroom in Patraix–Arrancapins (€235,000)

Our first example is a 56 m², 2-bedroom flat in Patraix, very close to Arrancapins, on the 5th floor, exterior, with lift, asking €235,000.

Key features:

56 m² built, 54 m² usable

2 bedrooms (one double, one single)

1 full bathroom

Bright living-dining room with exterior balcony

Modern kitchen with island

Individual heating and air conditioning

West-facing, in a 1960 building in good condition with lift

Price per m²: about €4,196/m²

Neighbourhood profile

Monteolivete is described in the listing as an authentic local neighbourhood, with:

Traditional local shops and services

Green areas

Quick links to the centre, the port and the City of Arts and Sciences

Walking distance to the Turia riverbed park

It is a good example of a district where expat investors can still find local prices with strong lifestyle appeal, without the tourist intensity of more central or beach-front neighbourhoods.

Investment and budget fit

At €225,000, this property sits right in the sweet spot for a buyer with a €250,000–€260,000 all-in budget:

ITP at 10%: around €22,500

Agency fee + VAT: about €8,200

Notary and registry: roughly €1,000–€1,500

You are looking at approximately €2,000 in extra costs, so a total spend in the region of €257,000.

The main trade-off at this price point is no lift. For many international tenants focused on lifestyle, the stairs are acceptable if the flat is bright, well-distributed and close to the Turia and City of Arts and Sciences.

For long-term resale value, the combination of location and layout is a strong plus.

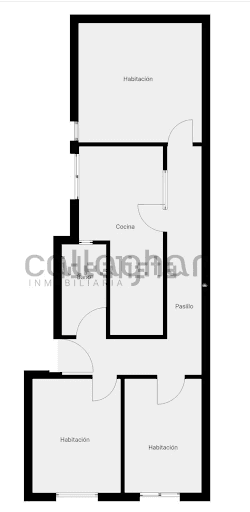

Case study 2 – bright 2-bedroom in Mont-Olivet, Quatre Carreres (€225,000)

The second example sits in Monteolivete (Mont-Olivet), within the Quatre Carreres district, an area that has attracted strong interest thanks to its position between the Jardín del Turia and the City of Arts and Sciences.

This listing is a 60 m², 2-bedroom flat, on the 3rd floor, exterior, without lift, asking €225,000.

Key features:

60 m² built

2 bedrooms, main with large built-in wardrobe

1 full bathroom

Independent kitchen

Cosy, exterior living room

Air conditioning

3rd floor exterior in a 1961 building without lift

East–west orientation

Price per m²: about €3,750/m²

Neighbourhood profile

Monteolivete is described in the listing as an authentic local neighbourhood, with:

Traditional local shops and services

Green areas

Quick links to the centre, the port and the City of Arts and Sciences

Walking distance to the Turia riverbed park

It is a good example of a district where expat investors can still find local prices with strong lifestyle appeal, without the tourist intensity of more central or beach-front neighbourhoods.

Investment and budget fit

At €225,000, this property sits right in the sweet spot for a buyer with a €250,000–€260,000 all-in budget:

ITP at 10%: around €22,500

Agency fee + VAT: about €8,200

Notary and registry: roughly €1,000–€1,500

You are looking at approximately €32,000 in extra costs, so a total spend in the region of €257,000. The main trade-off at this price point is no lift. For many international tenants focused on lifestyle, the stairs are acceptable if the flat is bright, well-distributed and close to the Turia and City of Arts and Sciences. For long-term resale value, the combination of location and layout is a strong plus.

Case study 3 – 2-bedroom close to the marina in El Grau, Poblats Marítims (€209,000)

Our third example is in El Grau, within Poblats Marítims, a coastal district that often delivers very competitive rental yields thanks to its position between the city and the beach.

This listing is a 60 m², 2-bedroom flat, on the 3rd floor exterior without lift, asking €209,000.

Key features:

60 m² built

2 bedrooms

1 bathroom

Balcony to the internal patio

Recently renovated: new plumbing and new kitchen

Most windows exterior, very bright

3rd floor exterior, no lift

Quiet, well-kept building

Price per m²: about €3,483/m²

Location and lifestyle

The flat is located on Calle de Méndez Núñez, in a quiet part of El Grau. The advert highlights:

5 minutes on foot to the port and marina with sailing boats

Around 15 minutes on foot to Playa de las Arenas

A calm building, clean portal and good neighbours

This is a classic example of a maritime urban location that works well for medium-term rentals, digital nomads and expats who want to be near the beach while staying connected to the city.

Investment and budget fit

Because it is listed by a private owner, there may not be a traditional agency fee, although buyers should always confirm this in each case. Using standard assumptions:

ITP at 10%: about €20,900

Notary and registry: around €1,000–€1,500

If an agency fee applies at 3% + VAT: around €7,600

In a typical scenario, you should plan for roughly €30,000 in total extra costs, bringing the total project cost close to €239,000. This fits comfortably within a €250,000–€240,000 total budget, leaving a small margin for minor improvements or furnishings.Given the recent renovation and proximity to the port and beach, this type of property is well suited to mid-term rental strategies, which are increasingly popular with expat tenants and remote workers who stay for several months at a time.

How to choose at this budget: location, stairs and rental strategy

These three examples show the practical trade-offs when buying property in Valencia with around €250,000 to allocate:

Central connectivity vs total budget

Patraix–Arrancapins offers great access to the centre and AVE, but at a higher €/m², pushing your total spend beyond €260,000.

Authentic, well-connected local district

Mont-Olivet delivers lifestyle value, proximity to Turia and the City of Arts and Sciences and a more moderate €/m², but without a lift.

Beach and marina proximity

El Grau gives you a renovated flat near the port and beach at the lowest ticket price, but again with no lift and a more local building profile.

From an investment standpoint, expat investors focusing on rental yields in Valencia will often prioritise:

Walkability and public transport

Light, layout and liveability, even in compact spaces

Neighbourhood story: emerging, beachside, near major parks or cultural hubs

Your strategy also matters:

For mid-term rentals, El Grau and Mont-Olivet are strong contenders.

For classic long-term rentals with easy resale, Patraix–Arrancapins is very attractive, provided your budget can stretch beyond €250,000 or you blend in financing.

Finally, remember that the Valencia market still faces limited supply and strong demand, so being prepared, clear on your priorities and realistic about costs is essential.

Conclusion

A €250,000 budget in Valencia in 2026 gives you access to well-located, liveable and increasingly popular neighbourhoods, but it is vital to work with the true numbers. Once you factor in ITP, notary, registry and possible agency fees, your effective purchase range is closer to €210,000–€225,000, as illustrated by real flats in Patraix–Arrancapins, Mont-Olivet and El Grau.

Each neighbourhood offers a different balance of centrality, beach access, building type and investment profile. Whether you prioritise being close to the AVE station, living next to the Turia and City of Arts and Sciences or walking to the marina and the beach, there are still realistic options for expat investors at this price level.

If you are considering property investment in Valencia and want to understand exactly what your budget can achieve in today’s market, professional guidance will help you identify the right area, property type and rental strategy for your goals.

Ready to explore investment opportunities in Valencia? Contact us today, and our team will help you find the right property and make the process seamless.